Dedicated to reshaping

workplace safety.

CompScience Careers

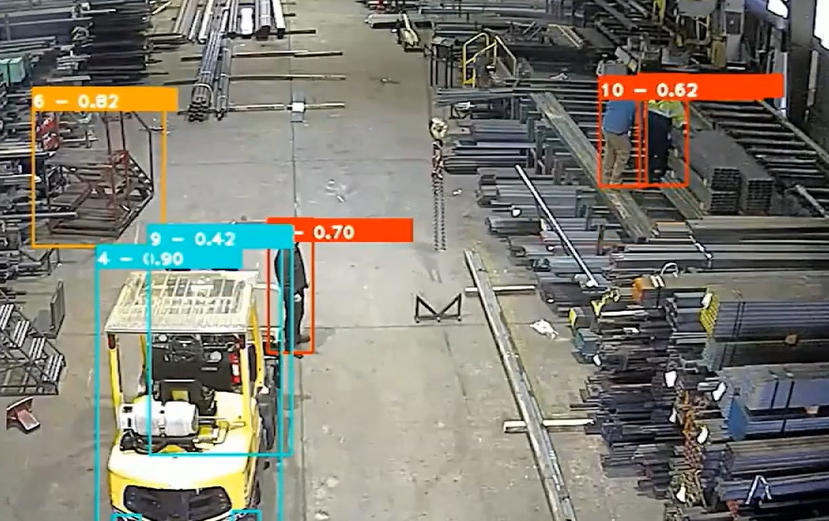

CompScience is dedicated to reshaping the way we think about workplace safety through award-winning advanced AI and computer vision. Our team comprises experts from top insurance firms like Liberty Mutual and Zurich, and leaders in technology innovation from Meta to Nio. Together, we’re driven to save lives and support safety-first companies with our pioneering AI technology.

Join us on a mission to prevent 10 million workplace injuries through bold technological innovations, ensuring that everyone can go home safe at the end of the day.

Why Work at CompScience

Joining CompScience means collaborating with a dynamic team passionate about using technology to make workplaces safer and more efficient. Here’s why you should consider being part of our mission:

Culture of Innovation

Meaningful Work

Remote Workforce

Collaborative Environment

Award-winning Product

Commitment to Well-being

It is not just a job; you’re embarking on a career journey with a company that cares about its people and the broader community it serves. Come be a part of a team that is dedicated to making a difference and pushing the boundaries of what tech can do to improve workplace safety.

Career Opportunities

Benefits and Perks

Four Medical Plans, including HSAs & PPOs

Company HSA Contribution

401k Plan

Employee Assistance Program that covers therapy

12 weeks of parental leave for births or adoptions

Company-paid Life Insurance, STD, LTD insurance

Fitness Reimbursement

Monthly Internet and Phone Reimbursement

Voluntary Life Insurance

Company-paid Ergonomics Assessment

Professional development through training and education