Webinar: Competitive Wedge

This webinar was hosted by CompScience to help insurance industry professionals understand a unique program that can make them more competitive. CompScience is easy for businesses to implement – they simply need to upload workplace videos. The program provides insights for better loss control, reduced exposures, improves safety in the workplace and lowers injury rates by 10-20%+ as well as lowering the total cost of risk. Producers can use the program at CompScience to retain clients, and win new business.

Full Transcript

Mike Seling:

Whether you’re prospecting for new business or renewing a current client, you’re constantly looking for an edge to win. Price and service are table stakes in this day and age, so what else do you bring to the table? For those who are Randy Schwan’s disciples, he would call this your wedge.

Today, Jacob and I are going to provide you with your wedge. We’re going to show you how to utilize our intelligent safety platform, powered by one of the world’s most advanced safety analytics technology platforms to help you win the business and protect your key renewals. As someone once told me in insurance, second place doesn’t pay very much.

Joining me today is Jacob Geyer. Jacob and I are a longtime co-workers. We have both a ton of experience in the insurance industry. We worked together for about 15 years at Accident Fund, a top 10 writer of work comp. Where together with our teams, helped grow the company to nearly $900,000,00 from around $450,000,000 or $460,000,00 in size. We’ve since reunited here at CompScience where we firmly believe our technology will help improve workplace safety, help reduce claims, and ultimately provide your client with a better risk profile.

Our presentation today is fairly brief and we’re simply going to focus on the following: we’ll outline a competitive advantage, call it a wedge, to give you an advantage against your competitors. We’re going to highlight a few examples of the dramatic improvement that we’ve seen at our clients, and ultimately review our two key deliverables that we provide and as always will provide next steps and an opportunity for Q&A at the end.

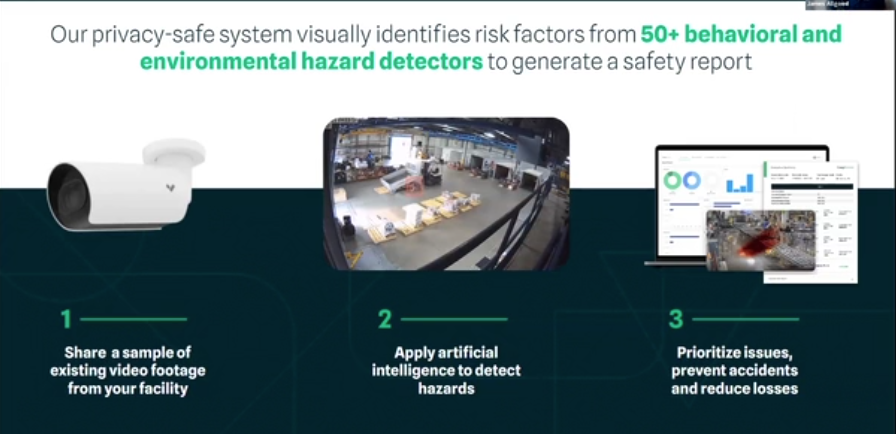

Over the next couple of slides, we’re going to highlight our industry leading platform that is easy for any business to implement. With our risk report and online app, business owners and leaders will have better insights for loss control, which will lead to reduced exposures and ultimately a safer workplace. Our platform will show and allow our clients to reduce injury rates by 10 to 20% to potentially even more, and ultimately they’ll experience a lower total cost of risk. Based on our target appetite all they need are cameras and the corresponding video footage for a moment in time. There are no devices for employees to wear, there’s nothing additional to purchase. It’s all included in our work comp policy

Jacob Geyer:

And as you can see on this slide, we’re delivering results. Our current customers average 66% reduction in hazards across all categories of loss. From the first risk report at policy inception to the second report, which is given to them just prior to the renewal of the policy. We’ve been working with some of the leading workers’ comp insurers and reinsures for years now. One note, The Hartford has been a fantastic partner of ours, and the pilot work we’re doing with them has been extremely successful to date. Our clients are generally mid to larger market in size, and as you can see, a lot of them are household names.

So let’s dive a little deeper into the difference between traditional loss control processes and what we’re doing here at CompScience. As an executive on a carrier side, I saw the traditional interaction of loss control, business development and customers, and how loss control can help drive better outcomes from a risk perspective. But traditionally, there’s really three big constraints that the loss control process has.

First of all, it’s impossible for them to physically observe all of the potential exposures within a facility. After all, loss control professionals are human. They have two eyes, and even if you had 10 of them at one time, there’s only so much that they’re able to pick up at any one point in time. Secondly, they’re not able to really quantify the exposures that they do see at the job site. They’re there only for a brief period of time, say an hour up to maybe two or three hours. Claims are often born out of repetition. Repetitive motions oftentimes lead to these injuries. And third, they can’t measure the improvements made from one loss control visit to another. Rather, they’re focused on what is the claims’ activity and hoping that those claims are avoided as they approach their policy renewal.

So what are we doing here at CompScience? Our safety platform, detects over 50 hazards out of the box, which represents 90% of the claims that occur on a day to day basis within workers’ comp. The process is fairly simple. A client uploads their video footage for a period of time, typically somewhere between a week and two weeks. There is no hardware installation required for our technology to work, and there is no active monitoring. And also only public areas where there’s already video being recorded is what’s utilized as we work through our AI. We put the footage through our proprietary computer vision and AI platform to summarize the exposures that we find within that week to two week sampling, and then we provide the client with a comprehensive risk report and an interactive app to share with their team, address hazards and ultimately reduce risk, which leads to a reduction in injuries.

All of our data is encrypted with military grade AES 256 encryption during transmission and it’s stored out on AWS, Amazon Web Services, protected by two-factor authentication. Now, one of the things that we’re most often asked as we work through this with agency partners, carriers and clients is data privacy. We take it very seriously here. If requested to delete the data, we will. We do not collect any personally identifiable information, and no data is collected beyond what the clients are already collecting at their facilities. This is the client’s hardware. This is not our hardware that is being installed on their premises.

Our detections fall into the four categories that are up on the screen right now. Now all these photos are actual footage from active clients of ours. First bucket is ergonomics, which is the leading cause of workplace injuries, and you can see some examples such as awkward posturing, environmental hazards. Struck by, forklifts, powered industrial trucks within these four wall spaces. Slips, trips and falls, which are often due to obstructed vision, housekeeping issues, jumping and climbing over things. And then the last one is caught in which really centers around machine guarding and then pin and pinch hazards.

Mike Seling:

So how does this all come together ultimately at the client’s facility? You can see on the screen. This is a two or three second video on continuous loop, and our computer vision draws a red box around a detection of a near miss. You can see here that what we have is a forklift operator almost hit a coworker with a pallet as he’s delivering a pallet to an already over stacked pallet jack. Meanwhile, the gentleman from the bottom is coming through with another pallet jack. So we’ve got a lot of congestion in this area. Of course, fortunately in this scenario, no one was actually injured, but at this client they had seen in their past an accident or two every so often, but they couldn’t never get their arms around how to ultimately prevent some of these accidents, both in terms of working with their staff as well as their carrier partners. Ultimately, when we were able to identify and quantify the various incidents, ultimately this led to better training toolbox talks, and other mapping out of the floor so that we could have pedestrians separate from the power truck vehicles.

We’ve got a couple of case studies that we want to draw your attention to, how this works at the client level. So in this first scenario, when we ultimately reviewed all of the footage and we put together the corresponding risk report, we utilize heat maps to draw attention to areas of the facility where there’s a high frequency. So you can see in the bottom right, we’ve got a heat map showing frequency at this area of a conveyor belt. When we go to the actual footage, we uncover that employees are hopping over the conveyor belt. They’re doing it because they’ve got production quotas to meet and to get around this conveyor system is simply too far of a walk, so they opted to hop over it instead. Which ultimately led to some injuries at work. When we brought the footage into our system, the first time we took a look over a two week period, we counted 570 instances of this happening.

Ultimately, we worked with the client to identify some solutions and initially they simply wanted to educate employees and tell them to stop. You can see when we came back a couple of weeks later and did another evaluation that did drop to under 300, but it still wasn’t good enough for the client. And so ultimately we identified the longer term solution, which was the installation of a lift gate. And you can see in subsequent periods we have essentially engineered that risk out of the company, ultimately ending in 2 the last time that we evaluated it.

On the next case study, we have a client where they saw a number of exertion and waist bend issues in their claims history. Similarly, we can see in the bottom right our software indicates a frequency of an issue happening at this section of the facility. And when we go to the computer vision, we can see that we’ve got a number of ergonomic issues in this case. The employee here has to bend over to manufacture these windows, and you can see within the exoskeleton just back is out of alignment and out of a net neutral position. Ultimately, we identified use of dollies and the purchase of A-line tables to correct for that. And you can see we’ve seen nearly a 60% reduction in this exposure for the client.

And then finally, in our last case study, here similarly we noticed a frequency of overexertion claims in this area of the facility and ultimately we see here’s some overhead lifting exposures. And what we were able to count in this case on the initial assessment, a little over 300 instances. Ultimately, again, by working with a client to identify typically pretty straightforward, oftentimes relatively inexpensive solutions. Again, in this case, the introduction of dollies to move the product from one area to the other. We ultimately removed most of that exposure, 95% of that exposure. The last time we counted the incidents, we have just 12 of them. So again, about a 95% reduction of that exposure.

Jacob Geyer:

So as mentioned before, once our analysis is complete, we provide the client both with a written risk report as well as access to the online app. The risk report benchmarks the risk levels of the client and opportunities for savings across the four largest categories of loss, ergo, slips, trips and falls, struck by and then caught in between. We provide ergonomist produced, REBA, which is rapid entire body assessment, analysis, and recommendations as well as various heat maps, which you can see in prior slides as well as on this one, which really shows where the bulk of the issues are occurring in the workspace. We also recently introduced an executive summary for those wanting a quick review of the issues, and the benchmarking we’ve done, as well as the predicted savings we foresee based on the recommendations that we’ve provided.

And this is a quick glance at the online app, which is available to the client, the executive team, safety manager, other risk management professionals, really anybody involved in workplace safety can access this. Everybody has access to this dashboard, which includes key drivers along with links to specific events that they can use to better understand the exposure. And this is a really neat way of using the app is, the client is able to go in, select one of the videos, and then they can use that in general training for the team. They can have toolbox talks. They can design procedures and use those videos as examples to eliminate those exposures as they’re working through the various safety recommendations that we provide.

Simply put, we have exponentially more data than what a person can see with their own eyes. We can quantify it, and then it can be used to mitigate workplace injuries, which in turn leads down to a reduction in experience mod, a reduction in risk and a reduction in the total cost of managing risks in the workplace. Really, this app becomes the ultimate place for the documented safety program for the customer, and then also is a great way of looking back at all of the things that they’ve done in the years of working with CompScience and how they’ve been able to engineer risk out of their workplace.

So what is our appetite? Really what we are doing is targeting mid to large size business, a minimum of 50,000 in premium and with most of those risks within four walls. Some target industries, I’ll just name a few of them on here. Manufacturing, retail and wholesale, prefab construction, food processing and wholesale as well as a few others. We’re currently licensed in 21 states. This map is going to continue to get more green as time goes along. Our intent over time is to be licensed in every state where workers comp is available.

This is where we’re at with both discussions with producers and with carriers. For producers and agency owners on the call who want to join us, we’ll provide you with a differentiation in the worker’s comp products to help win and retain your key accounts. If you reach out to Mike or myself, we’ll provide you with a producer agreement and a follow up email along with additional collateral to share with your clients. And then also, you’ll receive a 20% commission on the first policy that you bind before the end of the year.

For the carriers that are on the call, you can expect more profitable submissions that are coming through CompScience with improved outcomes, a risk reports which contain objective, verifiable information on the risks that we detected, as well as the recommendations as we work through those risks with the policyholder. And then submissions that you may not have otherwise received, and the ability to write and retain that. And just real quick, so everybody knows, just within the last week we received over $3,000,000 of submissions from our agency partners, so we’re really starting to ramp up right now and it’s a fantastic time to join in and get the CompScience advantage.

Mike Seling:

Thanks Jacob. And with that we’re going to open it up to questions. There is a Q&A section of this webinar. Simply type in your questions and we will answer them during the webinar. We received a handful of them and so I’ll go through them one by one. The first one that came in is, “How many risk reports does a client get per policy term?” Two is the standard. Typically, what we’re going to do once we quote, bind, issue the policy, our team will work with a client to identify and upload that footage. We will create our first risk report, which identifies and quantifies the exposure. We’ll also give them access to the app, and then our team is going to work with that client throughout the next five or six months to identify and implement solutions to mitigate those exposures. We’ll then go back to the client. We’ll get another pull of data and then again, take that through our analysis, provide a secondary risk report just in time for the renewal process. At that time, you’ll have a before and an after, or the ability to do a comparison and quantify how much that exposure reduced over the policy term. As you can imagine, it sets a pretty nice story for the renewal term.

Second question is, “What if the client is in a captive, or self-insured, or doesn’t want to leave their current carrier?” We can sell the software as a service. Normally the process is we will quote, bind, issue an insurance policy where we’re the agent of record. In these cases we can also quote the software as a service, in which case the client gets all of the same level of service, the same reports, everything is done exactly the same except they have to pay for the cost of the software. In turn, we will pay the producer on the account that provided us the opportunity with a 20% commission on that software sale. Then once the policy comes up for renewal, if it’s in a guaranteed cost program, we would still have the opportunity to quote that policy and then provide the software free of charge.

Let’s see here. We talked about this I think a little bit. “How secure is the transmission of video footage in the corresponding storage at CompScience?” All of the data is encrypted military grade AES 256 bit encryption, dual factor authentication, Amazon Web Service, the whole nine yards. And if the client does ultimately want the information deleted from the servers, we will do that as well. Let’s see here. “Is CompScience an insurance carrier or do you place the business for producers?” So we are not a carrier. Technically, we are a wholesale partner. We like to refer to ourself as a program administrator. The retail agent would submit business to us. We will in turn send it to AmTrust and CompWest depending on the state, other carriers as we finalize contract negotiations and we will provide back to the retail agent those various quotes and then ultimately, again, bind and issue them. We are not the insurance carrier.”How does it work if the company doesn’t have cameras installed?” Our appetite and our target premium is such that typically those clients would have cameras. If for whatever reason they do not have cameras, we have a couple of solutions. One is simply walk away, because we need that camera footage to take it through our AI and computer vision platform. The client, if they’re committed to installing those cameras ASAP, that would be a fantastic solution. And remember, cameras anymore are a couple hundred dollars each. They’ve come down a ton in price, and they’re fairly economical to buy and install these days. I suppose a third solution could be the rental of cameras. Cause again, we simply need a week or two worth of footage typically in the 50 to 100 hour area, and we could temporarily put some cameras on site, the client could and then we could take that footage in from them. Let’s see here. Jacob, do you want to take the next one?

Jacob Geyer:

Yeah, so, “How much time do you need for analysis from data collection to report?” It really depends on how quickly we’re able to get the data from the client, and as long as it’s full and complete, our intent is to have the first report available and push to the client within about six weeks of the effective data. The policy, of course, if we’re able to get to them more quickly and perform both our video compatibility check and our data review, we could move up that timeline a bit more. And then really what we do is we want to provide enough time in between the readout of the first report and the data collection of the second report, so that they can implement the recommendations that we provide. So that second report is usually somewhere between the eight and nine month mark. So as a policy is coming up on renewal, they are able to see the impact that they’ve made based on the recommendations that we’ve provided-

Mike Seling:

I’m going to give an additional answer to that just in case, because I read it a little bit differently as, “How much video footage do we need?” And so if that was the line of the question, the short answer is, it depends. But typically we’re grabbing 50 to 100 hours of video footage over a week or two. It could be more depending on the size of the facility, how many locations they have, how many cameras, so it can vary. But typically a week or two’s worth of data in the neighborhood of 50 to 100 hours.

Jacob Geyer:

Yeah, sure. “How much lead time do you need on a submission?” As much lead time as you have. Ideally what we’re looking for is 60 to 90 days out, but I know that there’s going to be last minute submissions that come in, you get a non-renewal notice or the income carrier is taking up the rate and you’re looking for a solution. We’ve been able to turn… Our intent is to be able to turn around any submission that comes into us within three days. We’ve gotten as quick as two business days to get a bindable quote from one of our carriers. But typically what we’re looking for is about that 60 day mark just to make sure that we have all the information gathered, we’ve given enough lead time to our carrier partners so that they can fully underwrite the risk and we can come up with a competitive solution.

Mike Seling:

Another one here says, “Do you actually provide the insurance paper or is it tied to a specific carrier? What is the software cost and what is it based on?” The first answer is we are currently contracted with AmTrust in all 21 of our states, CompWest as well out in California. So any submission that comes to us for the work comp policy solution, we will quote it with those two carriers. And with time we will have a couple of additional carriers as well. Remember, we’re not a wholesaler in the traditional sense that we give you access to markets. The markets we’re going to bring you are likely ones you currently have, rather the value we bring is in the software, in identifying and quantifying those workplace exposures.”What is the cost of the software and what is it based on?” So if we write the work comp policy, there’s no cost to the insured other than the cost of the work comp policy, which is going to be competitively priced. Our commission that we retain after paying the retail agent is enough to cover the cost of the software as well as a small profit margin for us. If instead the client is in the captive, they are self insured, or they want to stick with their current carrier, maybe they’ve got a really good claim’s adjuster they’ve worked with, we can ultimately quote the software as a service. The short answer there is also is depends, but let me give you a sense for what the software might cost as a standalone. We price it in terms of a 50,000 foot facility with up to 10 cameras.

In that sense, the soft road run about 10 to $15,000 per year. If they have twice the size of the facility, don’t necessarily expect the two x multiplier to that quote. Rather, we’re going to take a look at the entire operation, how much total square footage, how many locations, how many cameras that they have in place, and ultimately our team will work with them to identify those key cameras within those facilities. And then our quote will be commensurate with that. Whatever that final quote is, and we can work with a client in terms of payment plans… We believe in our software platform. We believe in what the products will do. So if you’ve got a client that maybe wants to try us a little bit, we can do a shorter version of the report, provide that to the client for free, and then ultimately if they see or once they see value in what we’re doing, then we can work together on a longer term solution, whether it’s the software play or the work comp policy as well.”Are you or your carriers offering any claim management services at the time of injury? For example, nurse triage.” We don’t do any of the claim’s handling or mitigation, anything like that. Ultimately between AmTrust and CompWest, they will provide all of the claim service, nurse triage, anything and everything is taken care of by our carrier partners. Within AmTrust, we have the Blue Line claim service, which is their top claims platform. And at CompWest, I don’t think they differentiate, rather they provide topnotch claim service at CompWest.

Jacob Geyer:

“Do you have a minimum video footage requirement?” Really the short answer is kind of. Again, as Mike mentioned, typically what we’re looking for is anywhere from 50 to a 100 hours within that first rapid sample that we receive. I think anything below 30, it’s going to be a little bit tough for us to pick up because what we’re looking at is multiple cameras in multiple different locations on different days and at different times. So when you combine all of those things, if somewhere only has two cameras, you can probably get away with fewer total hours. But if somewhere has 10 cameras, you’re going to want to make sure that you’re gathering enough information and enough video that you can glean important recommendations out of that. So we do stick to that 50 to 100, but there are cases where we could dip down a little bit lower than that.”Do the carriers give advanced credits for commitment to a CompScience analytics program?” There is no specific filing that is made by our carriers, but with that being said, we have seen some cases where there has been additional consideration given in pricing knowing that we are going to be involved and that we’re going to be working to get those better outcomes. So nothing official, but it certainly is a part of the discussion in the underwriting process. We also feel that there is a positive selection bias just from the fact that these policyholders want this technology and want to be working with us in creating a safer work environment.”Are the reports from the video review just raw data? Do you have a staff of safety professionals?” The report is not just raw data. What we are able to do is we’re able to break down that video into the cases where there was a deviation from the norm. So where we do see those risks that are occurring, that is the raw data that’s available on the app. And then what we do is we incorporate all of that into our risk report. In terms of the question of safety professionals, yes. We have both a head of loss control, Chris Mizelle, as well as a staff ergonomist, Lauren Wandell, and those are full-time staff members on our team that are professionals in their various areas of expertise. Let’s see.

For the ergonomic feature, “Does the technology provide a REBA, RULA risk score that would help the risk? Has the technology been used in causation for workers’ comp claims?” So in terms of causation, that is a great question. I’m going to dance around this as best I can that. The thing that I will say is, that is not the primary intent of our software as an organization. Our mission is to reduce workplace injuries, and also we do not gather personally identifiable information. With that being said, if causation is a concern for a client, it is something that we can certainly look into and utilize. But again, we’re not gathering any additional video footage than what the policyholder is already taping. But we can apply our technology in some form and function for this, but it is not the primary purpose.

In terms of the REBA risk score, yes, we do. Our staff ergonomist does focus on the highest priority risks as we go through that process and really figure out which ones are the most in the red, if you will, in terms of the potential severity of those repetitive motions and those ergonomic issues for the customer.

Mike Seling:

And then last one, “Are the CompScience assessments shared with the carrier loss control staff that workers comp policy is written with?” It can be, yes. Our goal is not to replace work that is done, whether it’s by the agency loss control staff or the carrier loss control staff, rather, it’s to augment what’s already being done. The whole purpose of our software is to be a little more, I’ll call it thorough, than what a human can ultimately do because of the various camera systems and the use of computer vision and AI. Initially, it’s going to be shared with the client as well as the broker partner, but ultimately if they want to share it with the carrier partner, they can do so as well. We don’t necessarily provide it right away, but certainly can upon request

One more came in, “Will there be a premium volume requirement and will there be some exclusivity to the broker partners?” A premium volume requirement, not in the traditional sense. Jacob and I aren’t going to sit here and say, “You have to have $1,000,000 of new business every year.” While it’s broadening seemingly daily, our appetite does require frankly the use of cameras being in place. So by that very nature construction for example, is currently being looked into. We don’t have a solution yet for that, but we are piloting some things with an agency partner of ours out in California. What we are targeting initially is those agency partners that frankly want to work with us and if they’ve got a half a dozen, a dozen opportunities a year, that’s the kind of people that we want to work with. Certainly if they have more, fantastic, but you’re not going to be beholden to a premium requirement per se.”Is there some exclusivity to the broker partners?” We do not plan to offer exclusive per se. At the same time, our intent is to not have every single broker in every state on every street corner. Rather, we will- I kind of go back to what I said before, we want to work with folks that want to work with us. And so ultimately early on there is going to be a lot of exclusivity. We don’t have hundreds or thousands of agency partners, so initially everyone will have largely exclusivity, but with time, you’ll ultimately have some competition in your state, but it’s certainly not going to be every street corner for sure. We’ll pause for a second and just see if any other questions come in. “Not really a question, but cool stuff.” Thanks Tim.

After this meeting, everyone in attendance can expect a couple of things from us. We will make available the recorded version of this webinar on our website. We may include it in the email as well. I’ll defer to Jeff, our VP of marketing on that. We will provide along for those that are potential agency partners, a producer agreement. We recognize that you may need to take it back to other folks within the organization to discuss internally, but you would never leave the office without a BOR letter, and we’re certainly not going to let you get off the phone without sending you a producer agreement. And then ultimately, we’ll provide additional marketing collateral as well. We’ve got one-pagers. We’ve got a one minute video. Certainly you can check out compscience.com, but ultimately we will provide you additional marketing collateral, the producer agreement, and access to this recorded webinar as well.

Jacob Geyer:

We did just get another question in. “Do you prefer high mod accounts?” Our technology really works across the spectrum. With that being said, high mod accounts are the ones that had claims activity and are really feeling the pain of having additional premium that is being paid. We envision that as time goes along, we’re going to have more and more clients that have debit mods and we’re going to work with them, provide the recommendations to reduce risk. With that being said, we do have clients that on the surface they appear to be relatively clean accounts, but the fact is there’s risk inherent in every operation. But we do see, based on the submissions that we’ve received to date, on average, the accounts do have a debit mod and whether it’s due to bad luck, large losses, frequency issues, we are able to work on all of those and ultimately work to get better outcomes.

Mike Seling:

Yeah. I would add to that, the work comp market is and has been competitively priced for years. I mean, everyone wants work comp. It’s really profitable. We are starting to see some signs of that changing. And so certainly when there is a debit mod, when there’s a history of claims, a solution like ours makes complete sense for those clients that maybe have infrequent claims, but they have the hazard. They’ve either been lucky or they do have some pretty good policies and procedures in place. I can assure you that when they do ultimately have claims, because things are so thinly priced, you’re going to see mod elevation occur pretty quickly. And so for those agents thinking, “Well, this doesn’t really apply to my credit mod account,” this could actually help get out in front and prevent them from having higher or debit mods in the future. So as Jacob said, it works across the spectrum, but wanted to give a little bit of additional detail down.”How are you able to pay 20% commission when AmTrust pays nine?” Well, a couple of things there. We get more than 9% from AmTrust. Typically, we’re going to get 15% from the carrier. We’re going to pass along to the agent somewhere in the neighborhood of eight to 10% depending on what we ultimately get from the carrier. But we’re essentially paying 20% in the near future for a couple reasons. We’re chalking this up to an investment in marketing and investment with our agency partners. The analogy I’ve given, this isn’t like going out and buying a TV or buying a phone. It’s not crystal clear in some cases to the agent, maybe in some cases to the client, what exactly we’re going to provide back the intent of 20%.

This is a critical time of year. Q4 is incredibly important, and certainly so is getting off 2023 on the right foot in January is critically important to anyone’s business plan. So frankly, we’re going to pay 20%. We’re going to lose a little bit of money on some of these accounts to gain agency partners that see the value in what we provide and ultimately want to spread the word within their agency and go out and use this like I said, as a wedge for protecting your current clients as well as prospecting for additional ones. So to answer the question, we will lose some money at 20% being totally transparent.

But to that point, for those that have opportunities, whether it’s a 12 one coming up, that you just got some notification of some pricing changes, if it’s a one one, if you’ve got opportunities that you think would fit our platform, you’ve got our email addresses on the screen, send them in, we can submit them to the carriers, work up some quotes. If it’s a SaaS opportunity, we can work on the software pricing as well, and we want to earn your business. We’re going to come back with a competitive quote and ultimately that will lead to wanting to be a contracted agency partner of ours. And then we can finish up the producer agreement in corresponding details from there. But if you’ve got opportunities, sent them our way and we’ll get cracking on them.

Otherwise, I’m thinking, folks… Did we get one more? Thank you. Otherwise, with that, how about giving you guys 16 minutes back of your time? Again, you’ve got our email addresses. If you want to email either of us any additional questions or want a live demo with your agency staff, if you want to show this to your key producers or fellow producers, account managers, you name it. I’m happy to jump on an agency specific call and walk through this. I also spend part of my day working on client specific demos. If you’ve got, again, a captive account or a large account that you want us to show them how it works, because you’re not quite up to speed, I will gladly jump on a call 15, 20 minutes and we can walk them through it. So just give us a shout and look forward to working with y’all. Thank you so much. Have a great day.

Jacob Geyer:

Thanks everyone.